Electoral Bonds Scheme UPSC: Electoral bonds are a unique financial mechanism that are exclusively available to political parties meeting specific criteria. According to the regulations stipulated under Section 29A of the Representation of the People Act, 1951, only political parties.

that have achieved a significant electoral presence by securing not less than 1% of the votes cast in the previous general election to either the House of the People or the Legislative Assembly are considered eligible to receive these bonds.

This stringent requirement ensures that electoral bonds are distributed to parties that have demonstrated a minimum level of public support, making it a targeted and accountable process for facilitating financial contributions to the political landscape.

Electoral Bonds Scheme UPSC

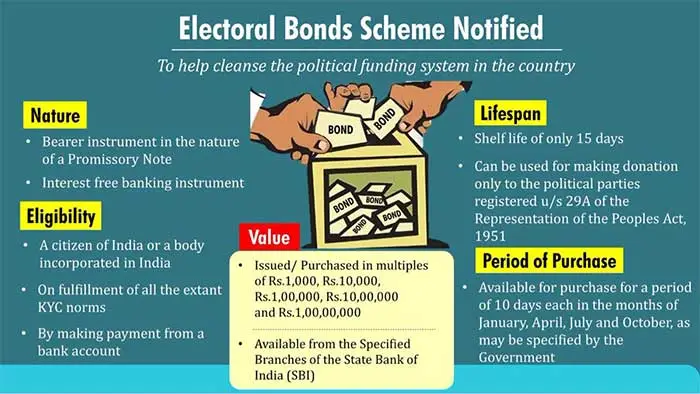

Electoral Bonds, initiated through the Finance Bill 2017 and officially put into action in 2018, are like special financial tools for donating to political parties. They work somewhat like regular bearer bonds or promissory notes. In this case, the bank issuing the bonds is the one responsible for safeguarding and giving the money to the political party when someone holds these bonds.

The topic of Electoral Bonds holds significance, especially for those preparing for the IAS Exam. It’s a noteworthy aspect of India’s political and financial scene, and understanding it is crucial for a well-rounded knowledge of the subject.

Electoral Bonds Latest News

Data on electoral bond sales obtained in May 2023 through India’s Right to Information Act revealed that just five cities accounted for 90% of the bonds sold thus far.

- Five cities, Mumbai, Kolkata, Hyderabad, New Delhi, and Chennai, accounted for nearly 90% of all electoral bonds sold so far, with Mumbai being the highest contributor at 26.16% of the total bonds sold.

- Bengaluru, the capital of election-bound Karnataka, accounted for just over 2% of total sales, despite being known as the tech capital of India.

- When it comes to the redemption of electoral bonds, the New Delhi branch of the State Bank of India (SBI) is the preferred choice, with 64.55% of all bonds redeemed so far being encashed in the capital.

- Hyderabad and Kolkata were distant second and third choices for redemption, respectively, while Mumbai, despite accounting for over 26% of all sales, had only 1.51% of all electoral bonds redeemed.

The concentration of political funding in a few cities under the Electoral Bond Scheme raises concerns about transparency and fairness in political financing, especially with anonymous donations.

Electoral Bonds – Introduction

Context: The current administration has suggested a number of measures relating to political fundraising, such as the issuance of Electoral Bonds, as part of its ongoing fight against both problems (black money and corruption).

Electoral bonds have the following characteristics and procedures:

- Notified banks are the ones issuing these bonds.

- The donor has the option to buy the bonds from these banks.

- The donor will be able to purchase the bonds with a check or a digital payment. As a result, the contributors’ identities are kept secret (if revealed, the donors might become embroiled in political conflict, particularly if they are businessmen).

- These bonds are given to the political party by the donor.

- It must be deposited into the political party’s account that is linked to the Indian Election Commission.

The significance of electoral bonds

- They make certain that the money that political parties are raising is clean money, or accounted for money.

Issues concerning Electoral Bonds

Even though the Electoral Bond Scheme acts as a measure against the old under-the-table donations since bonds are through cheques and digital paper trails of transactions, there are many key provisions of the scheme that are causes of concern.

Anonymity: There is no obligation on the part of the donor (individual or corporate) or the political party to reveal where the donations come from.

Transparency: It will also go against transparency, a fundamental principle in political financing. Companies will no longer have to declare the names of the political parties to which they have donated, so shareholders won’t know where their money has gone.

- There are possibilities of making electoral bonds a convenient channel for black money. The following provisions are controversial in that sense:

- Doing away with the 7.5% cap for corporate donations.

- No need for companies to reveal their political contributions in their profit and loss statements.

- The requirement that companies should be in existence for 3 years before making political contributions undermines the scheme’s intent. This makes it easy for dying, troubled or shell companies to make an unlimited donation anonymously.

- Since the bonds are bought through the State Bank of India (SBI), the government is always in a position to know who the donor is. This asymmetry of information threatens to favour whichever political party is ruling at the time.

- The Election Commission of India had asked that the limit for reporting the donations (which is Rs 20000) should be brought down to Rs 2000, but instead, the government has reduced the maximum contribution by cash to Rs 2000.

- It could become a convenient channel for business to round-trip their cash parked in tax havens to political parties for a favour or advantage granted in return for something.

Drawbacks of Electoral Bonds

- The RPA (Representation of People Act 1951) although makes it mandatory for the political parties to disclose donations over Rs 20000, there is no law that prohibits these parties from disclosing donations below Rs 20000 but the parties lack political will hence do not disclose

- The political parties have regularly delayed submitting the audited reports to the ECI. As per ADR between 2011-2015

- BJP has delayed the submission on an average by 182 days

- Congress by 166 days

- NCP by 87 days

Worse is the fact that some political parties do not even file the returns. There is little to show that action has been against these parties who have either delayed or not filed the returns.

- The political parties can continue to collect the funds through cheque and digital payments (but will have to file returns to the Income Tax authority)

Hence there are some concerns associated with the usage of electoral bonds. Then, what is the way out of this?

- As per T S Krishnamurthy (Former CEC), the government will not know how many times, the bond has been sold in the market before being encashed by the political party. So it would be better if an Election Fund is set up by the EC and donations to various political parties are collected by ECI (with compulsory PAN number)

- The above suggestion of setting up of election fund has been given by Indrajit Gupta Committee

Electoral Bond – Electoral Trust

- Is it a Section 25 company (formerly known as a Section 8 business under the Companies Act of 2013)?

- This is only being done to raise money for a political party and send it to the relevant political party.

- 2013 saw the release of operational rules for the Electoral Trust by the CBDT.

- These will increase openness from both the donor and the recipient sides (political parties).

- Over a dozen trusts have established themselves thus far, but their intended goal is not being met.

- A small portion of the total donations collected by political parties—there are over 1800 political parties in India, according to ECI—are directed through trusts.

- Only five trusts revealed donations in 2014–15, indicating how few trusts are making contributions public.

Electoral Bond – What is Section 25 Company (or Section 8 Company)?

- Does an entity have a registration under The Companies Act of 1956, section 25?

- US 25 permits the establishment of a charitable company without the need to create a Trust or Society; the company will function as a separate legal entity. The catch is that any company created under this section must use or reinvest all income toward accomplishing the same goal; in other words, unlike a regular company, no money will leave the company in the form of profits or dividends.

Advantages

- very simple to assemble

- There are no minimum capital requirements.

- Much simpler to administer: there is a minimal quorum requirement to hold board meetings, it is simple to join the board, etc.

- Benefits from taxes are given

Conclusion:

If you’ve any thoughts on the Electoral Bonds Scheme UPSC 2023 then feel free to drop them in the below comment box. Keep visiting our website: sevakyojana.com for new updates.

I hope you like this post so please share it on your social media handles & Friends. Don’t forget to subscribe to our newsletter to get new updates related to the posts, Thanks for reading this article till the end.

electoral bonds Scheme UPSC vision ias, electoral bonds Scheme UPSC questions, electoral bonds Scheme UPSC minimum value, electoral bonds Scheme UPSC drishti +ias,electoral bonds Scheme UPSC denomination, electoral bonds Scheme UPSC drishti ias in hindi,electoral bonds can be UPSC purchased by foreigners, electoral bonds Scheme UPSC tax benefits