Mandhan Yojana: The Indian government has introduced three pension schemes to ensure financial security for its citizens during retirement. Each scheme serves different sectors of the population and is managed by specific agencies:

Mandhan Yojana, a government-backed pension scheme, is a ray of hope for individuals seeking financial security during their retirement years in India. In this article, we’ll delve into the details of this scheme, its benefits, eligibility criteria, and how it can be your ticket to a worry-free retirement.

Mandhan Yojana

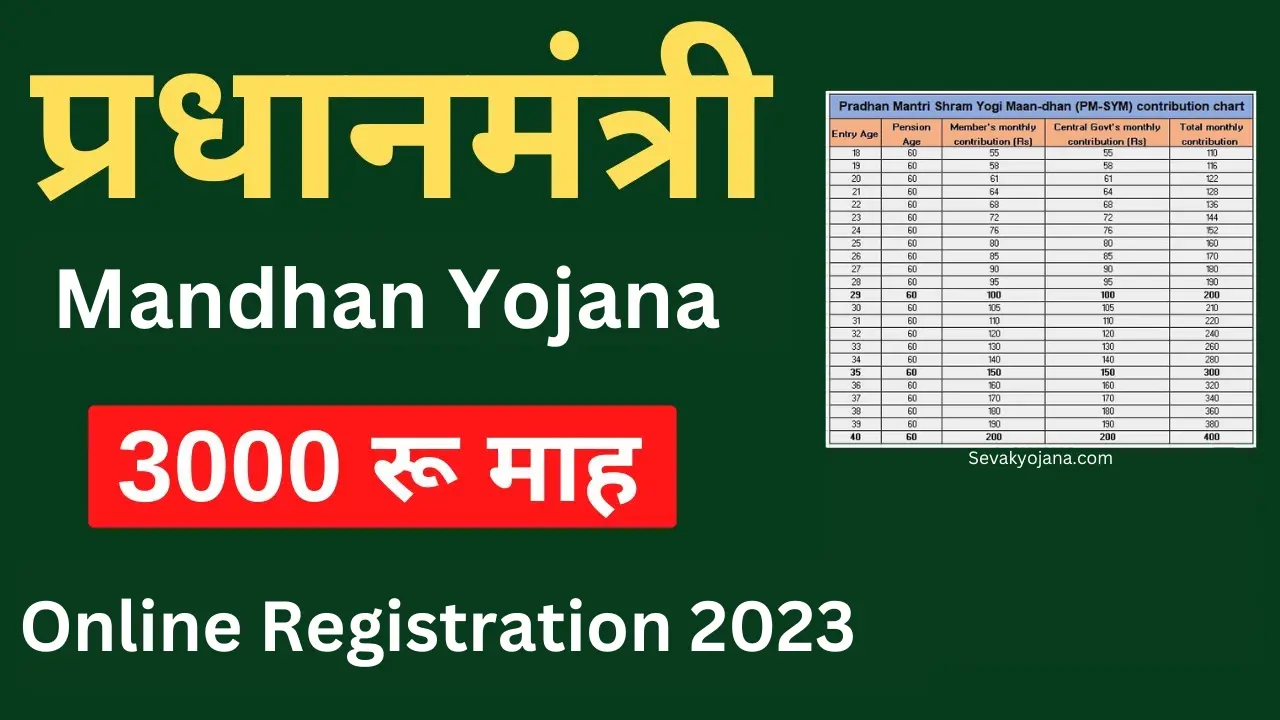

Under the Atal Pension Yojana (APY), participants are entitled to a monthly pension of Rs 3000 once they reach the age of 60. The scheme offers an attractive incentive for those who enroll at a younger age. If you join the scheme at 18 years old, your monthly premium will be a mere Rs 55. This affordable premium ensures that you can secure a stable pension in your retirement years without a significant financial burden.

In contrast, if you decide to participate in the scheme at the age of 40, your monthly premium will be Rs 200. While this is a higher premium compared to those who enroll at a younger age, it still provides an accessible pathway to building a reliable pension fund for your post-retirement life.

These differential premium rates encourage early enrollment, allowing individuals to plan for their financial well-being during their golden years while keeping their contributions manageable. The Atal Pension Yojana offers a flexible and affordable solution for individuals from various age groups to secure a comfortable retirement.

- Atal Pension Yojana (APY): This scheme provides a regular pension to those working in the unorganized sector. The Common Services Centre (CSC eGovernance Services India Ltd. – CSC SPV) manages the enrollment, and the Life Insurance Corporation of India (LIC) is responsible for overseeing pension funds and payouts to eligible participants.

- National Pension System (NPS): NPS is a voluntary, long-term savings plan open to all Indian citizens, including both organized and unorganized sector workers. CSC eGovernance Services India Ltd. assists in enrolling participants, and LIC serves as one of the Pension Fund Managers. NPS offers various investment options to help people build their retirement savings.

- Employees’ Pension Scheme (EPS): This scheme caters to organized sector employees under the Employees’ Provident Fund Organization (EPFO). It provides pensions to EPF members who meet specific criteria. EPFO oversees the management of EPS, and LIC may play a role in managing pension funds for certain employees as a Pension Fund Manager.

These pension schemes, supported by the Indian government, aim to provide financial stability during retirement. They help individuals plan for a secure and comfortable future by collaborating with entities like the Common Services Centre and LIC to efficiently enroll participants and ensure the timely distribution of pension benefits to eligible beneficiaries.

Mandhan Yojana Overview

| Sr | Name of the Scheme | Date Launch | Nodal Ministry |

| 1 | PM Shram Yogi Mandhan Yojana | 5/3/2019 | Ministry of Labour & Employment |

| 2 | PM Laghu Vyapari Mandhan Yojana (National Pension Scheme for traders and self-employed persons) | 12/9/2019 | Ministry of Labour & Employment |

| 3 | PM Kisan Mandhan Yojana | 12/9/2019 | Ministry of Agriculture & Farmer Welfare |

Mandhan Yojana Key Features

- Eligibility: To be eligible for the Mandhan Yojana, you must be between 18 and 40 years of age and working in the unorganized sector.

- Affordable Premium: The scheme is incredibly affordable, with a monthly contribution ranging from Rs 55 to Rs 200, depending on your age at enrollment.

- Pension Benefits: Under this scheme, beneficiaries are entitled to a monthly pension of Rs 3,000 after reaching the age of 60, providing a stable financial cushion for your retirement.

- Nominee Benefits: In the unfortunate event of the beneficiary’s demise, the nominated spouse will receive a pension.

- Government Support: The government contributes an equal amount to your monthly premium, further enhancing the benefits.

Features of these schemes are as below

- Common prerequisites for qualifying.

- The scheme is open to everyone between the ages of 18 and 40.

- Be not entitled to an income tax assessment.

- Not eligible for NPS, ESI, or EPF coverage.

- Monthly subscription fees for members would range from Rs. 55 to Rs. 200.

- After enrolling in the program, the subscriber must pay a periodic fee until they turn sixty years old.

- The Indian government will provide an equal sum.

- As old-age protection, the beneficiary will be qualified to receive a monthly pension of Rs. 3,000 after turning sixty years old. If the subscriber passes away while receiving pension, his widow will be entitled to half of the family pension that the qualified subscriber was receiving.

- Accounts broken down by member for both government and member contributions are kept up to date.

- If the subscriber doesn’t pay their subscription for up to a year, they can still use the scheme by paying the arrears with interest.

- Subscribers receive communication through 15 different forms of SMS at different stages. After three years of enrollment, members are free to leave the program at any time.

- The spouse may choose to either in the event that the subscriber passes away before their pension starts.

- Either continue the program by making recurring payments OR withdraw from the program and receive a refund.

Why Mandhan Yojana Matters

The unorganized sector comprises a significant portion of the Indian workforce, including daily wage laborers, street vendors, and more. These individuals often lack access to formal pension plans, leaving them financially vulnerable during their retirement.

Mandhan Yojana addresses this issue by providing them with an affordable and accessible avenue to save for their post-working life.

Mandhan Yojana Benefits

- Financial Security for Unorganized Workers: Mandhan Yojana is tailored to meet the specific needs of unorganized sector workers, making it a critical tool in enhancing financial security for this demographic.

- Affordable and Accessible: The scheme’s low premiums and wide age eligibility range make it a viable option for a large segment of the population.

- Government-Backed: As a government-backed initiative, Mandhan Yojana assures participants of reliable benefits and support.

- Nominee Provisions: The scheme also considers the welfare of beneficiaries’ families, offering a pension to the spouse in the event of the participant’s demise.

Target Groups: (on the basis of self-declaration)

Pradhan Mantri Shramyogi Mandhan Yojana:

The Pradhan Mantri Shramyogi Mandhan Yojana is a government initiative designed to provide financial security to workers in the unorganized sector who earn less than Rs. 15,000 per month. This scheme extends its benefits to a diverse range of occupations, including home-based workers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washermen, rickshaw pullers, landless laborers, own account workers, agricultural workers, construction workers, beedi workers, handloom workers, leather workers, audio-visual workers, and similar vocations. The overarching goal of this scheme is to empower these hardworking individuals by offering them a pension plan that ensures their financial well-being during retirement.

Pradhan Mantri Laghu Vyapari Mandhan Yojana:

The Pradhan Mantri Laghu Vyapari Mandhan Yojana is part of the National Pension Scheme tailored for traders and self-employed persons. It benefits Laghu Vyaparis, self-employed individuals, and entrepreneurs whose annual turnover does not exceed Rs. 1.50 crores. Laghu Vyaparis encompass a broad spectrum of occupations, including shop owners, retail traders, rice mill owners, oil mill owners, workshop owners, commission agents, brokers of real estate, owners of small hotels and restaurants, and other such Laghu Vyaparis. This scheme aims to provide a safety net for these enterprising individuals, allowing them to save for their post-retirement life and secure their financial future.

Pradhan Mantri Kisan Mandhan Yojana:

The Pradhan Mantri Kisan Mandhan Yojana focuses on the welfare of small and marginal farmers who own up to 2 hectares of cultivable land, as documented in the land records of the concerned state or union territory. This scheme is a boon for the agrarian community, offering them a means to safeguard their economic stability in later years. By providing a pension scheme specifically tailored to the needs of small and marginal farmers, the government seeks to ensure that these vital contributors to the nation’s agriculture sector enjoy a dignified and secure retirement.

In summary, these government initiatives are designed to address the unique needs of workers in the unorganized sector, traders and self-employed individuals, and small and marginal farmers, respectively. They aim to create a sustainable and secure financial future for these diverse segments of the population, promoting economic well-being and social security.

Conclusion:

Mandhan Yojana, the Pradhan Mantri Shram Yogi Maandhan, is not just another pension scheme. It is a beacon of hope for millions of unorganized sector workers seeking a secure and dignified retirement.

By providing affordable premiums, substantial pension benefits, and government support, this scheme ensures that financial stability in retirement is attainable for all. Enroll in Mandhan Yojana today and take the first step toward securing your future.