Udyogini Scheme The Indian government’s Udyogini initiative assists women in launching their own enterprises. It provides funding to disadvantaged women to launch their businesses. The Women Development Corporation of India oversees this project.

The Udyogini Scheme’s objective is to assist women in starting their own businesses. It assists them in increasing their earnings both at home and independently by offering financial aid. In the end, this initiative is essential to the advancement of women and the growth of the country.

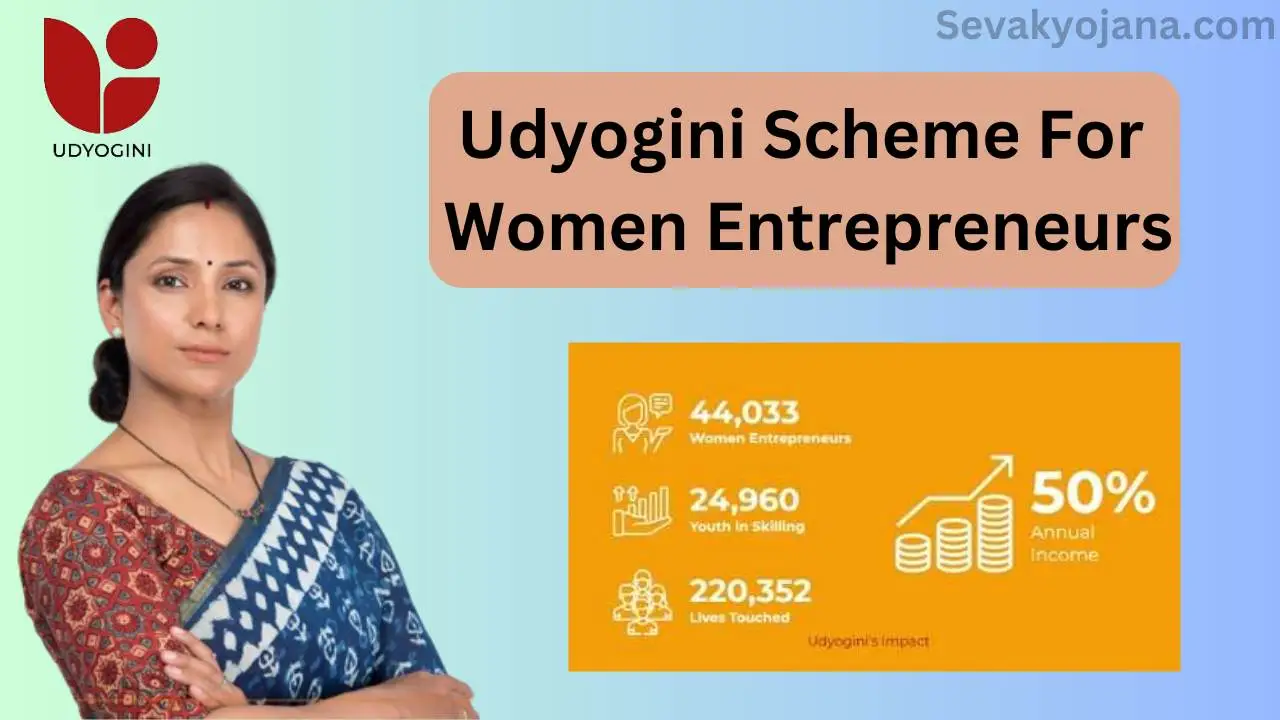

Udyogini Scheme For Women Entrepreneurs 2024

Banks offer uncommon plans to assist ladies ended up self-reliant. One such conspire is the Udyogini Conspire, which isn’t specifically run by the Central Government but is executed by banks beneath government informational. It’s backed by both non-banking money related companies and government and private banks, giving credits for different trade exercises.

The Udyogini Plot offers interest-free credits to ladies beginning little businesses, pointing to engage them fiscally. Ladies can get to advances up to Rs. 3 lakhs to begin 88 diverse sorts of little businesses, advancing their soundness. Qualified candidates can get credits without any constrain for impaired ladies and dowagers. Depending on their commerce and qualification, they may qualify for extra credits.

This conspire energizes and underpins female business, particularly among underprivileged ladies in rustic regions. It not as it were boosts person and family earnings but moreover contributes to national development. Ladies from all foundations can get to interest-free credits without any inclination. Moreover, female agriculturists who possess businesses can moreover advantage from interest-free advances given by banks.

Udyogini Scheme Details in Highlights

| Name | Udyogini Scheme 2024 |

| Introduced by | Government and Women entrepreneurs in India |

| Implemented by | Government of India’s Women Development |

| Interest Rate | Competitive, subsidized, or free for special cases |

| Annual Family Income | Rs. 1.5 lakh or less |

| Loan Amount | Max. up to Rs. 3 lakh |

| No income limit | For Widowed or disabled women |

| Collateral | Not required |

| Official Website | Click Here |

Objectives of Udyogini Scheme

To support women’s success, the Udyogini Scheme has specific objectives. Its primary goal is to provide women with the capital to launch their own enterprises, thereby increasing their financial independence. In order to provide women from all backgrounds with access to capital to launch their businesses, this involves providing interest-free loans. In doing so, the program also seeks to increase household incomes—particularly in rural areas where employment is rare.

Udyogini Scheme Benefits

- Women can get interest-free loans to start or grow their businesses, giving them the money they need to succeed.

- It helps women become financially independent, giving them control over their lives and futures.

- Women entrepreneurs can create job opportunities, benefiting their communities by providing employment.

- Successful businesses mean more income for women, improving their quality of life and supporting their families.

- The scheme often includes training sessions to enhance business skills, making women better entrepreneurs.

- It helps women reach more customers, expanding their business and boosting sales.

Eligibility Criteria For The Udyogini Scheme

- The applicant must be female.

- Previously, the age limit for women was 45 years, but it has now been extended to 55 years, allowing women aged 18 to 55 to apply.

- The previous income cap was Rs. 40,000, but it has been raised to Rs. 1.5 Lakhs.

- Only female business owners are eligible for business loans.

- Applicants with a good credit score and a history of making timely payments are preferred.

- Ideally, applicants should not have defaulted on any previous loans from financial institutions.

Documents needed for Udyogini Scheme

- Passport size photographs

- Aadhaar Card

- Birth Certificate

- Duly filled Application Form with

- Address and Income Proof

- Applicant’s Below Poverty Line (BPL) card & Ration Card

- Caste Certificate, if applicable

- Copy of Bank passbook (account, bank and branch names, holder name, IFSC, and MICR)

- Any other document required by the bank/NBFC

List of enterprises participating in the Udyogini Yojana

| Agarbatti Manufacturing | Diagnostic Lab | Leaf Cups Manufacturing | Ribbon Making |

| Bangles | Edible Oil Shop | Milk Booth | Shops & Establishments |

| Audio & Video Cassette Parlour | Dry Cleaning | Library | Sari & Embroidery Works |

| Bakeries | Dry Fish Trade | Mat Weaving | Security Service |

| Banana Tender Leaf | Eat-Outs | Match Box Manufacturing | Shikakai Powder Manufacturing |

| Bottle Cap Manufacturing | Fish Stalls | Old Paper Marts | Soap Oil, Soap Powder & Detergent Cake Manufacturing |

| Beauty Parlour | Energy Food | Mutton Stalls | Silk Thread Manufacturing |

| Bedsheet & Towel Manufacturing | Fair-Price Shop | Newspaper, Weekly & Monthly Magazine Vending | Silk Weaving |

| Book Binding And Note Books Manufacturing | Fax Paper Manufacturing | Nylon Button Manufacturing | Silk Worm Rearing |

| Cleaning Powder | Gift Articles | Photo Studio | Tea Stall |

How To Apply For The Udyogini Scheme?

To apply for this scheme or yojana, applicants have two options. They can either visit the nearest bank with all the required documents and complete an application form to fulfill the necessary bank requirements. Alternatively, candidates can opt to submit a loan application online by visiting the official websites of banks participating in the Udyogini program.

FAQs About Udyogini Scheme 2024

1.What is the Udyogini Scheme?

The Udyogini Scheme is a government initiative aimed at empowering women entrepreneurs by providing them with financial assistance to start or expand their businesses.

2.Who is eligible to apply for the Udyogini Scheme?

Eligibility criteria typically include being a woman between the ages of 18 to 55, having a certain income level (usually up to Rs. 1.5 Lakhs), and being a business owner.

3.How can I apply for the Udyogini Scheme?

Applicants can visit their nearest bank branch with the required documents and fill out an application form. Alternatively, some banks allow for online application through their official websites.

4.What documents are required to apply for the Udyogini Scheme?

Required documents may include proof of identity, address, income, business registration, and any other relevant certificates or permits.

5.What types of businesses are eligible for funding under the Udyogini Scheme?

The scheme typically supports various types of small-scale businesses, including retail, agriculture, and other entrepreneurial activities.

Conclusion

If you’ve any thoughts on the Udyogini Scheme 2024 Check Eligibility, Required Documents then feel free to drop them in the below comment box. Keep visiting our website: sevakyojana.com for new updates.

I hope you like this post so please share it on your social media handles & Friends. Don’t forget to subscribe to our newsletter to get new updates related to the posts, Thanks for reading this article till the end.